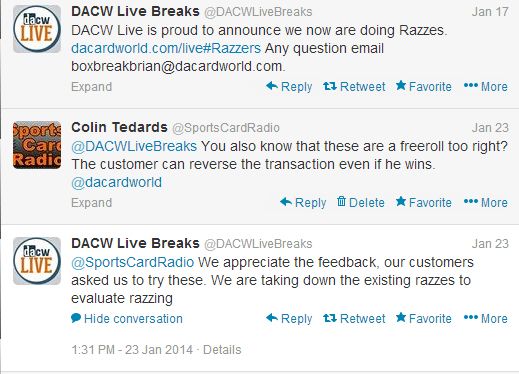

A while back I did a podcast where I talked about DA Card World’s Hit Parade packs, which I actually thought were a good idea – and probably a decent attempt to make some money. Just from surfing around the internet, I’ve also seen DA Card World running ads through Google, usually on a broad range of websites … which is a good way to waste money. That’s why you own GOOG stock, sit back and laugh all the way to the bank. Anyway, the other day DA Card World thought it was a good idea to put up raffles (razz) that are as illegal as the sky is blue. The excuse for running these illegal contests was to basically blame their own customers for requesting them!! If your customers asked for everything to be 50% off – would you do it DA Card World? Nope. So stop blaming your customers for requesting them. If DA Card World was bogged down with orders of traditional un-opened boxes, they wouldn’t have time (or need) to come up with illegal raffles, re-packaged junk, or run ads.

Speaking of freerolls. Group breaking is a freeroll. For those of you that aren’t clued in: you can buy into a group break … get all the cards shipped to you – request a refund from PayPal and they will give you your money back. Period. End of conversation. Those in the industry, including summit ‘organizers’ I talk about later have latched onto the group breaking business because it’s driving sales of crap that would just be sitting on the shelves of card stores or DA Card World. Let’s all just close our eyes and dream a little …. let’s assume group breaking blows up into a multi-million dollar business. That’s when PayPal (or worse – the DOJ) will come to crush you like the little cockroach you are. If you all depend on this money stream – you better A) lobby some politicians to change the rules (like big companies do) or B) find an attorney that can find a loophole you can use to do group breaking legally … and without the risk of charge-backs. The scamming of group breakers will only increase (as idiots like me tell you how easy it is) – but I don’t write or make the laws. I certainly wouldn’t want to rely on a paycheck from a business model so ripe for scams & charge backs. When you all go to zero one day – I can at least say I warned you to legitimize your revenue stream before someone of real importance decides to crush you.

Leaf’s owner Brian Gray sues people all the time. Most of the time I could care less on the outcome. However, if he wins his current lawsuit against Kevin Isaacson, the operator of the “Industry Summit” – I might try to piggy back his ruling … even if it’s just to re-connect with a college roommate who’s a prominent attorney now in the Bay Area. I went to the Industry Summit back in 2011, 2012 and made a great decision to attend a different Las Vegas Summit in 2013 – that has paid for the cost of attendance ten-fold. At the sports card industry summit I saw a lot of card shops struggling to make ends meet. Good ideas are brought up at the Industry Summit, but the people in charge of executing on those ideas is a revolving door of ‘little guys‘ who haven’t changed the sports card business in 20 years – all while facing increasing costs & competition. The fact is, Kevin Isaacson is probably a bigger idiot than the people that pay him thousands to have a ‘booth’ at an off-strip Vegas conference with only a few hundred of attendees. He said – just last year – Blowout Cards & DA Cards would never get into group breaking. I’ve been covering group breaking since 2008 – it doesn’t shock anyone (especially me) that low margin retailers would jump into group breaking … especially if those group breaks were eating into the sales of traditional un-opened boxes. Now the same guy who didn’t see the group breaking industry consolidating thinks its a good idea to turn people away from his event – without any terms-of-service or contract on his website! Isaacson is part of the ‘good ‘ol boy’ network that barely scrapes by in this business. A few of those ‘good ‘ol boys’ told him they don’t like Leaf – or Sports Card Radio for that matter, since neither of us are scared to tell our customers the truth. Isaacson runs an event every year to cater to the handful of businesses that feel like blowing a few thousand to get in front of a few hundred – don’t be surprised if he’s not around in a few years … much like many of the attendees.

Sports cards are still distributed via a wholesaler – despite an increase in royalty payment to leagues – and an ever decreasing number of hobby shops in existence. Brian Gray (the owner or Leaf trading cards) said in the forum thread I link to earlier that he did ‘nearly 20 million’ in sales last year. Lets say Leaf gives 25% margin to distributors on those sales (it’s probably higher than that). That’s $5,000,000 dollars. If you rented a 100,000 sq foot warehouse (way too big) at $1/sq foot (way too much – but probably a reflection of true cost after insurance & other costs) PLUS had 4 employees you paid $50,000 each (way too much pay) – you’d add $3.6 million dollars to your bottom line without increasing your sales! Not to mention you could become a distributor of other licensed products or gaming cards from companies too lazy to hire a few people & rent a building. If you think these distributors do a bunch of selling – you’re wrong. Recently they’ve been marking down 2013 Panini products, and didn’t order enough 13/14 Panini Titanium Hockey – forcing Panini to distribute it via Canadian retailers and their own online shop. Distributors in other industries supply warranties, have a catalog, and in-general are only valuable if you are selling a product that needs to be distributed to certain areas of the country. For example – a San Francisco 49ers T-Shirt isn’t going to sell too well in Seattle – so if you were a licensed T-Shirt maker, you’d probably want a distributor who already knows this to effectively sell your product to the right retailers … saving you lots of time and un-sold items. Football cards are football cards – the same set sells in New England will sell in Los Angeles – there’s no need to use a distributor in the Sports Card business … except possibly when dealing with Target/Wal-Mart given the size of those orders.

Michael Eisner is one of the more public faces behind the Topps Company. It was Eisner’s Tornante Company, along with Madison Dearborn Partners who took the company private several years ago. A few months ago Topps went to the debt markets looking to raise $175 million dollars to refinance current debt (at a ~6% interest rate) and fund operating costs. One of the more interesting nuggets is that Eisner’s group ‘only’ owns 25% of Topps – which isn’t much skin in the game for an uber-rich guy.

If you think Panini is looking forward to next seasons NBA & NFL drafts that features Johnny Manziel, Jabari Parker among others – they’re not! …. actually they probably are, like anyone in this business, but what really has their mouth watering is the 2014 World Cup. The CEO predicts it will be the ‘biggest business in (Panini’s) history.’ Another interesting note is that 70% of Panini’s collectibles division is through sicker album sales. In short, sports cards is a tiny business – even for Panini Group.